Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Seven Critical Attributes for Selecting an NDC API Partner in the Airline Industry

Authors: Shahan Taj Mohammed

DOI Link: https://doi.org/10.22214/ijraset.2024.64256

Certificate: View Certificate

Abstract

This article examines seven critical attributes that airlines should consider when selecting an NDC API partner for enhancing their distribution capabilities. These attributes include technical skill, airline industry knowledge, project management experience, travel industry market knowledge, quality and operational excellence, NDC certification, and future-proofing capabilities. By evaluating potential partners based on these criteria, airlines can ensure successful NDC implementation and establish strategic distribution partnerships. The article provides insights into each attribute, highlighting their importance in the context of the evolving airline distribution landscape and the challenges associated with NDC adoption. It emphasizes the significance of choosing the right partner to navigate the complexities of modern distribution, optimize offer management, and ultimately deliver superior value to customers.

Introduction

I. INTRODUCTION

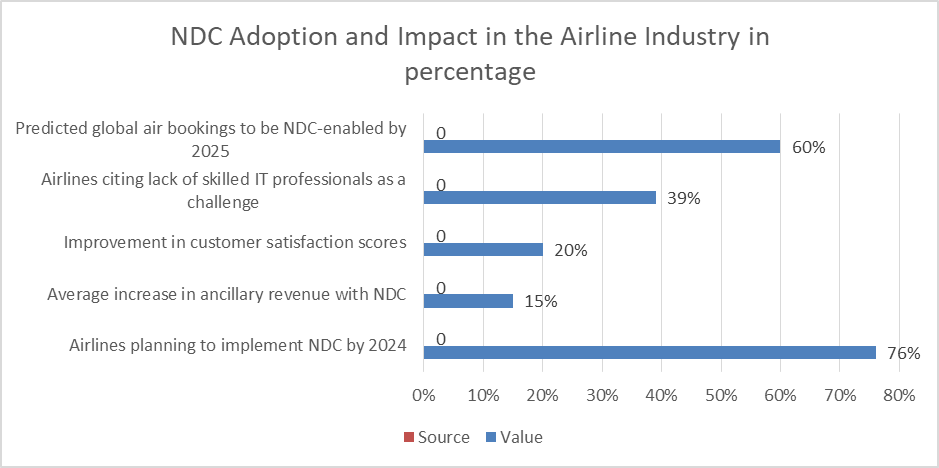

The airline industry is experiencing a profound transformation in its distribution landscape, with New Distribution Capability (NDC) emerging as a pivotal technology standard. As the sector rebounds from recent global disruptions, the adoption of NDC has accelerated, driven by airlines' strategic imperative to exert greater control over their product offerings and elevate the customer experience. According to SITA's Air Transport IT Insights 2023, 76% of airlines are planning to implement NDC by 2024, highlighting the rapid pace of adoption [1]. This XML-based data transmission standard, developed by the International Air Transport Association (IATA), is revolutionizing the way airline products are distributed, marketed, and sold.

NDC enables airlines to overcome the limitations of traditional distribution systems, allowing for rich content delivery, dynamic pricing, and personalized offers. This capability is crucial in an era where travelers increasingly expect tailored experiences and transparent pricing. Amadeus reports that airlines implementing NDC have seen an average increase of 15% in ancillary revenue and a 20% improvement in customer satisfaction scores [2]. By implementing NDC, airlines can differentiate their products more effectively, potentially increasing ancillary revenue and customer satisfaction.

However, the successful implementation of NDC is not without its challenges. It requires a significant overhaul of existing systems and processes, as well as seamless integration with various stakeholders in the travel ecosystem. SITA's report indicates that 39% of airlines cite the lack of skilled IT professionals as a significant challenge in their digital transformation efforts [1]. This is where the role of an NDC API (Application Programming Interface) partner becomes critical. Effective NDC API development and integration demand a partner with a unique blend of technical expertise, industry knowledge, and strategic vision.

This article delves into seven essential attributes that airlines should prioritize when selecting an NDC API partner. These attributes are crucial for ensuring not only a successful initial implementation but also for establishing a foundation for long-term success in the evolving landscape of airline distribution. By carefully evaluating potential partners based on these criteria, airlines can position themselves to fully leverage the benefits of NDC, enhancing their competitive edge in a rapidly changing market.

As we explore these attributes, it's important to recognize that the right NDC API partner will play a pivotal role in an airline's ability to navigate the complexities of modern distribution, optimize their offer management capabilities, and ultimately deliver superior value to their customers. Amadeus predicts that by 2025, over 60% of global air bookings will be NDC-enabled, underscoring the importance of this strategic decision [2]. The selection process, therefore, is not merely a technical decision but a strategic one that can significantly impact an airline's future market position and customer relationships.

Fig 1: Key Metrics for NDC Implementation and Its Effects [1, 2]

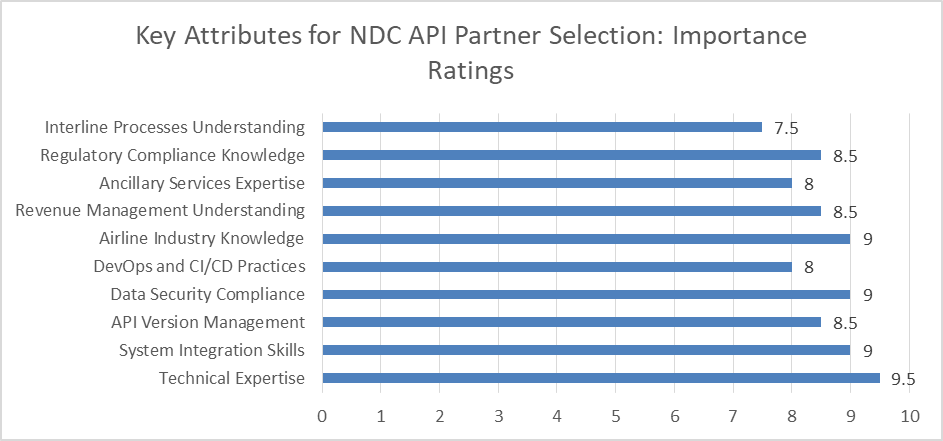

II. KEY ATTRIBUTES FOR NDC API PARTNER SELECTION

A. Technical Skill

The cornerstone of successful NDC API integration is the partner's technical expertise. In the complex ecosystem of airline distribution, where legacy systems often coexist with cutting-edge technologies, the technical prowess of an NDC API partner is paramount [3].

1) Airlines Should seek Partners who Demonstrate

- Expertise in Developing Scalable, End-to-End Solutions: The partner should have a proven track record in creating robust, scalable solutions that can handle the high-volume, real-time transactions typical in airline distribution. This includes expertise in cloud-based architectures, microservices, and containerization technologies that enable flexible and scalable deployments.

- Strong Understanding of System Architecture and Integration Challenges: Given the complexity of airline IT landscapes, partners must possess in-depth knowledge of various system architectures. This includes understanding the intricacies of Passenger Service Systems (PSS), Global Distribution Systems (GDS), and other critical airline platforms. The ability to navigate and integrate with these diverse systems is crucial for seamless NDC implementation.

- Proficiency in API Version Management: NDC standards evolve, and so do the APIs that implement them. A competent partner should demonstrate expertise in managing multiple API versions concurrently, ensuring backward compatibility while enabling airlines to leverage the latest NDC features. This includes implementing robust versioning strategies and providing clear migration paths for older API versions.

- Ability to Integrate with Existing Booking Engines and Other Airline Systems: The partner should have experience in integrating NDC APIs with various booking engines, inventory management systems, and revenue management platforms. This integration should be seamless, ensuring that NDC capabilities enhance rather than disrupt existing operations.

2) Technical skills should be evaluated based on

- Past Project Portfolios: A thorough review of the partner's previous NDC implementations, focusing on the scale, complexity, and outcomes of these projects. Case studies and client testimonials can provide valuable insights into the partner's capabilities and problem-solving approach.

- Technical Certifications: Look for partners with relevant industry certifications, such as IATA NDC certifications, cloud platform certifications (e.g., AWS, Azure, Google Cloud), and software development certifications. These credentials indicate a commitment to maintaining up-to-date technical knowledge.

- Demonstration of Problem-Solving Abilities in Complex Integration Scenarios: Partners should be able to articulate their approach to challenging integration scenarios. This could include handling edge cases in offer management, resolving conflicts between NDC and traditional distribution channels, or optimizing performance in high-load situations.

3) Additionally, airlines should consider the partner's expertise in

- Data Security and Compliance: Given the sensitive nature of passenger and payment data, partners must demonstrate robust security practices and compliance with industry standards like PCI DSS and GDPR.

- Performance Optimization: The ability to design and implement high-performance APIs that can handle peak loads without compromising response times is crucial for maintaining a seamless booking experience.

- DevOps and Continuous Integration/Continuous Deployment (CI/CD): Partners should have established DevOps practices that enable rapid, reliable updates and maintenance of the NDC API infrastructure.

By thoroughly evaluating these technical aspects, airlines can ensure they select a partner capable of delivering a robust, scalable, and future-proof NDC API solution that aligns with their strategic distribution goals. The rapidly evolving nature of airline distribution technology, as evidenced by the ongoing research and industry developments reported in the Journal of Air Transport Management [3], underscores the importance of selecting a technically adept partner who can navigate this dynamic landscape.

B. Airline Industry Knowledge

Beyond technical skills, a deep understanding of airline-specific processes is crucial for any NDC API partner. The complex, interconnected nature of the air transportation system demands comprehensive knowledge of industry-specific operations and dynamics [4].

1) The ideal Partner should Demonstrate Expertise in

- Availability Management Systems: Understanding the intricacies of how airlines manage and distribute their inventory is essential. This includes knowledge of real-time inventory management, capacity controls, and the complex interplay between different fare classes and booking classes. As Bouarfa et al. point out, these systems involve multiple agents interacting in complex ways, necessitating a deep understanding of emergent behaviors in air transportation [4].

- Schedule Management: Proficiency in airline scheduling practices is crucial. This includes understanding seasonal variations, flight frequency optimization, and the impact of network planning on distribution strategies. The partner should grasp how schedule changes affect availability and pricing, and how these changes need to be reflected in NDC-based distribution.

- Fare Structures and Pricing Mechanisms: Comprehensive knowledge of airline pricing strategies is vital. This encompasses understanding fare bases, fare rules, and dynamic pricing models. The partner should be adept at translating these intricate pricing structures into NDC-compatible formats, enabling airlines to offer personalized and dynamic pricing through NDC channels.

- Interline Agreements and Processes: As airlines continue to collaborate through alliances and codeshare agreements, understanding the complexities of interline processes is essential. The partner should be well-versed in how interline agreements affect ticketing, baggage handling, and revenue sharing, and how these processes can be effectively managed within the NDC framework.

- Ticketing and Reservation Systems: A deep understanding of airline reservation systems, including Passenger Name Records (PNRs), Electronic Ticketing (ET), and various status codes used in the industry is necessary. The partner should be capable of integrating NDC solutions with existing reservation systems, ensuring seamless data flow and maintaining the integrity of booking information across all distribution channels.

2) Moreover, the Ideal Partner Should Demonstrate Knowledge in

- Revenue Management Principles: Understanding how airlines optimize revenue through inventory control, overbooking strategies, and yield management techniques. This knowledge is crucial for implementing NDC solutions that support advanced revenue management practices.

- Ancillary Services and Merchandising: Expertise in how airlines package and sell ancillary products and services, and how these can be effectively distributed and priced through NDC channels.

- Regulatory Compliance: Familiarity with aviation industry regulations, including those related to distribution, pricing transparency, and passenger rights across different regions.

- Industry Standards and Practices: Knowledge of IATA resolutions, recommended practices, and other industry standards that govern airline distribution and operations.

The research by Bouarfa et al. highlights the complexity of air transportation systems, emphasizing the need for partners who can navigate this complexity [4]. Their work on agent-based modeling and simulation of emergent behavior in air transportation underscores the importance of understanding the intricate interactions between various components of the airline industry. This understanding is crucial for developing NDC solutions that can effectively integrate with and enhance existing airline systems.

By selecting a partner with deep airline industry knowledge, airlines can ensure that their NDC implementation not only meets technical requirements but also addresses the complex business needs and operational realities of the aviation sector. This industry-specific expertise is crucial for developing NDC solutions that truly enhance an airline's distribution capabilities and contribute to its strategic objectives, while also being able to adapt to the emergent behaviors and unforeseen challenges that are inherent in such a complex system.

Fig 2: Relative Importance of Technical and Industry Knowledge Factors in NDC API Partner Selection [4]

C. Proven Project Management Experience

Successful NDC API integration requires more than just technical expertise. It demands a structured, disciplined approach to project execution that can navigate the complexities of airline systems and processes. A comprehensive study by the Project Management Institute (PMI) found that organizations with mature project management practices complete 89% of their projects successfully, compared to only 34% for organizations with low maturity [5]. This stark contrast underscores the critical role of project management in technology implementations like NDC API integration.

1) When Selecting a Partner for NDC API Integration, airlines should Prioritize Those with

- A strong track record of completing similar projects: Airlines should seek partners who have successfully implemented NDC solutions for other carriers, particularly those of similar size or with comparable operational complexities. Case studies and client testimonials can provide valuable insights into a partner's capabilities. For instance, a partner who has successfully integrated NDC APIs for a major international airline with multiple hubs and a complex route network would be well-suited for similar large-scale projects.

- Effective project management methodologies: Partners should demonstrate proficiency in popular frameworks such as Agile, Scrum, or PRINCE2. These methodologies provide structured approaches to planning, executing, and controlling projects, which can be particularly beneficial in complex integrations like NDC API implementation. For example, Agile methodologies can help teams adapt quickly to changing requirements, which is often necessary in the dynamic aviation industry. A 2022 survey cited in the PMI study found that 71% of organizations that adopted Agile practices reported faster time-to-market for new products and services [5].

- Clear communication protocols: Establish expectations for regular status updates, stakeholder meetings, and escalation procedures. Clear, consistent communication helps maintain alignment among all parties involved and enables quick resolution of any issues that arise. This might include daily stand-up meetings for the core project team, weekly status reports for department heads, and monthly executive briefings.

- Transparent resource allocation strategies: Partners should provide clarity on team composition, roles, and responsibilities. This includes detailing the expertise and availability of key personnel throughout the project lifecycle. For instance, a well-structured team might include a project manager, business analysts, NDC API specialists, integration experts, quality assurance testers, and a dedicated customer success manager.

- Risk management and mitigation strategies: Proactive identification and planning for potential risks can significantly reduce project disruptions. Look for partners who conduct thorough risk assessments and have concrete plans for addressing common challenges in NDC implementations. The PMI study found that organizations with mature risk management practices are twice as likely to meet their project goals and three times as likely to stay within budget [5].

2) Key indicators of strong project management include

- Detailed project timelines and milestones: These should be clearly defined and communicated to all stakeholders at the project's outset. A comprehensive project plan should include specific deadlines for key deliverables, such as system design approval, development completion, testing phases, and go-live dates.

- Regular progress reports and stakeholder communications: Frequent updates help maintain alignment and quickly address any issues. This might include weekly status reports, bi-weekly steering committee meetings, and monthly executive briefings.

- Flexibility to adapt to changing project requirements: In the dynamic aviation industry, the ability to pivot and adjust project scope is essential. Look for partners who have experience managing change requests and can demonstrate how they've successfully adapted to evolving client needs in past projects.

- Cross-functional team coordination: Effective project management in NDC API integration often involves coordinating diverse teams, including technical experts, business analysts, and stakeholders from various departments such as sales, marketing, and customer service. A partner with experience in managing multi-disciplinary teams can help ensure smooth collaboration and a holistic approach to the integration process.

- Quality assurance and testing protocols: Robust testing procedures are crucial for ensuring the reliability and performance of the NDC API integration. Partners should have well-defined quality assurance processes, including unit testing, integration testing, and user acceptance testing (UAT). The PMI study highlighted that organizations with standardized testing processes are 28% more likely to complete projects on time and within budget [5].

- Post-implementation support plan: The project doesn't end at go-live. Look for partners who offer comprehensive post-implementation support, including training for airline staff, troubleshooting, and ongoing optimization of the NDC API integration. This ensures a smooth transition and helps maximize the long-term value of the NDC implementation.

By prioritizing these project management attributes, airlines can significantly increase their chances of a successful NDC API implementation. A partner with strong project management skills can help navigate the complexities of the integration process, ensure alignment with business objectives, and deliver a solution that enhances the airline's distribution capabilities in line with IATA's NDC standard.

|

Project Management Attribute |

Importance (1-10) |

Impact on Project Success (%) |

|

Track Record of Similar Projects |

9 |

85 |

|

Effective PM Methodologies (e.g., Agile) |

8 |

71 |

|

Clear Communication Protocols |

9 |

80 |

|

Transparent Resource Allocation |

7 |

65 |

|

Risk Management Strategies |

8 |

75 |

|

Detailed Project Timelines |

9 |

82 |

|

Regular Progress Reports |

8 |

78 |

|

Flexibility to Adapt |

7 |

70 |

|

Cross-functional Team Coordination |

8 |

76 |

|

Quality Assurance and Testing Protocols |

9 |

85 |

|

Post-implementation Support Plan |

8 |

72 |

Table 1:Critical Project Management Attributes for Successful NDC API Integration [5]

D. Travel Industry Market Knowledge

The global nature of the airline industry necessitates a partner with broad market knowledge. According to a comprehensive study by the International Air Transport Association (IATA), the airline industry operates in a complex ecosystem involving 1,478 commercial airlines, 3,864 airports, and 27,000 aircraft serving 45,091 routes worldwide [6]. This vast network underscores the importance of partnering with entities possessing extensive market knowledge.

1) This Attribute encompasses

- Understanding of regional market dynamics: This includes insights into local travel patterns, seasonal trends, and consumer behavior across different geographical areas. For instance, partners should be aware of how cultural events like Lunar New Year in East Asia or Oktoberfest in Germany can significantly impact travel demand.

- Familiarity with local regulations and compliance requirements: Aviation is a highly regulated industry, with each country having its own set of rules. Partners must be well-versed in diverse regulatory frameworks, from the Federal Aviation Administration (FAA) in the United States to the European Union Aviation Safety Agency (EASA) in Europe, and the Civil Aviation Administration of China (CAAC) in China.

- Awareness of market-specific distribution channels and preferences: Different markets may favor various booking channels. While online travel agencies (OTAs) might dominate in some regions, others may still rely heavily on traditional travel agents. Understanding these nuances is crucial for effective distribution strategies.

- Ability to manage critical timelines across different markets: This involves navigating time zone differences, diverse business practices, and varying holiday schedules to ensure smooth operations and timely project delivery.

Partners with this knowledge can help airlines navigate the complexities of global distribution and ensure compliance with various regional requirements. They can provide valuable insights into market entry strategies, help tailor offerings to local preferences, and assist in developing targeted marketing campaigns that resonate with specific audiences.

Moreover, such partners can aid in identifying and capitalizing on emerging market opportunities. For example, they might recognize the potential in rapidly growing markets like India or Southeast Asia, where rising middle-class populations are driving increased air travel demand.

In the context of NDC API integration, market knowledge becomes particularly crucial. It enables partners to adapt the API implementation to cater to market-specific needs, such as supporting local payment methods, currency conversions, or integrating with popular regional metasearch engines.

Ultimately, a partner with comprehensive travel industry market knowledge can be a significant asset in helping airlines expand their global reach, optimize their distribution strategies, and stay competitive in an increasingly complex and interconnected marketplace.

E. Quality and Operational Excellence

The partner's commitment to quality and operational excellence is paramount for fostering long-term success and maintaining a competitive edge in today's dynamic business environment. When evaluating potential partners, it is essential to scrutinize their dedication to upholding high standards and implementing efficient operational practices [7].

One of the primary aspects to consider is the presence of robust quality assurance processes. These processes should be comprehensive, covering all stages of project execution, from inception to delivery. A well-structured quality management system ensures that deliverables consistently meet or exceed client expectations, minimizing the risk of errors and rework.

Equally important is the partner's commitment to consistency in deliverables. This consistency demonstrates reliability and professionalism, which are crucial for building trust and long-term relationships with clients. Partners should have standardized procedures and templates in place to ensure uniformity across projects and teams.

Transparency in operations and reporting is another critical factor. Open communication channels and regular, detailed reporting mechanisms foster trust and enable effective collaboration. This transparency allows for timely identification and resolution of potential issues, ensuring smooth project progression.

Adequate resourcing is vital to ensure timely project delivery. Partners should have a clear understanding of their capacity and the ability to scale resources as needed. This includes having access to a pool of skilled professionals and the flexibility to allocate them efficiently across projects.

1) Several indicators can help assess a partner's quality and operational excellence

- ISO certifications or other quality management system implementations: These certifications, such as ISO 9001, provide objective evidence of a partner's commitment to quality management principles and continuous improvement.

- Client testimonials and case studies: These offer valuable insights into a partner's track record of consistent performance and their ability to deliver results across various projects and industries.

- Clear escalation procedures: Well-defined processes for issue resolution demonstrate a partner's proactive approach to problem-solving and their commitment to client satisfaction.

- Continuous improvement initiatives: Partners who invest in ongoing training, process optimization, and technology adoption show a dedication to staying ahead of industry trends and enhancing their service offerings.

By carefully evaluating these aspects of quality and operational excellence, organizations can identify partners who are well-equipped to contribute to their success and drive mutual growth in the long term.

F. NDC Certification

NDC (New Distribution Capability) certification is a vital indicator of a partner's expertise and commitment to implementing IATA's NDC standard in the airline industry. As airlines seek to enhance their distribution strategies, prioritizing partners with strong NDC capabilities has become increasingly crucial [8].

When evaluating potential partners, airlines should place significant emphasis on NDC certification, with a particular focus on those who have achieved Level 4 certification. According to IATA, Level 4 certification demonstrates a partner's ability to handle comprehensive offer and order management capabilities, which are essential for full NDC implementation [8].

1) Level 4 Certification Encompasses a wide range of Functionalities, Including

- Creation of offers

- Airline-driven dynamic pricing

- Rich content distribution

- Ancillary services management

- Order creation and management

- Servicing capabilities

Partners who have attained Level 4 certification showcase their commitment to providing airlines with advanced distribution solutions that align with the industry's evolving needs. This certification ensures that the partner can effectively support airlines in delivering enhanced customer experiences and optimizing their distribution strategies.

Beyond certification, airlines should also consider partners who are actively involved in NDC working groups or industry forums. IATA encourages such involvement through various programs and events, as it signifies a deeper engagement with the NDC ecosystem and suggests that the partner is at the forefront of industry developments [8].

2) Participation in These Groups often Translates to

- Early access to upcoming NDC features and enhancements

- Influence on the direction of NDC standards

- Collaboration with industry leaders and innovators

- Sharing of best practices and lessons learned

Furthermore, a partner's commitment to staying current with NDC standard updates is crucial. IATA regularly releases new versions of the NDC standard, introducing new capabilities and improvements [8]. Partners who prioritize staying up-to-date with these changes demonstrate their dedication to providing cutting-edge solutions and ensuring long-term compatibility with airline systems.

3) To Assess a partner's Commitment to NDC, Airlines can

- Review the partner's NDC certification level on IATA's NDC Registry

- Inquire about their roadmap for adopting future NDC versions

- Evaluate their technical expertise and resources dedicated to NDC development

- Assess their ability to integrate NDC solutions with existing airline systems

In conclusion, NDC certification, particularly at Level 4, serves as a strong indicator of a partner's capabilities in the realm of modern airline distribution. By prioritizing partners with this certification, active industry involvement, and a commitment to ongoing NDC development, airlines can position themselves to leverage the full potential of NDC standards. This approach aligns with IATA's vision for a more flexible and efficient distribution landscape, ultimately enhancing airlines' distribution strategies and improving the customer experience [8].

G. Future-proofing

- The airline distribution landscape is in a constant state of flux, driven by rapid technological advancements and evolving consumer expectations. To navigate this dynamic environment successfully, airlines must carefully select partners who demonstrate a steadfast commitment to innovation and long-term support. This commitment is crucial for ensuring that airlines can adapt to new market demands and technological shifts without major disruptions to their operations [8].

- A forward-thinking partner should prioritize staying at the forefront of New Distribution Capability (NDC) and ONE Order developments. These IATA-led initiatives are reshaping the way airlines distribute content and manage orders, promising enhanced personalization and streamlined operations. By aligning with a partner well-versed in these standards, airlines can ensure they remain competitive in an increasingly digital marketplace. For instance, a partner with expertise in NDC version 21.3 or higher can help airlines implement advanced features like dynamic offers and continuous pricing.

- Investing in research and development for future enhancements is crucial. This commitment should be evident through a clear and comprehensive roadmap that outlines planned technological advancements and feature implementations. Such foresight allows airlines to anticipate and prepare for upcoming changes, maintaining a competitive edge in the industry. A robust roadmap might include plans for integrating artificial intelligence for predictive analytics, blockchain for secure transactions, or Internet of Things (IoT) technologies for improved baggage tracking and aircraft maintenance.

- Long-term support and maintenance are equally vital considerations. As distribution systems become more complex and integrated, the need for reliable, ongoing support becomes paramount. Look for partners with a track record of providing robust maintenance services and a demonstrated ability to adapt their support structures as technologies evolve. This might include 24/7 technical support, regular system health checks, and proactive monitoring to prevent potential issues before they impact operations.

- Flexibility in accommodating future airline needs is another key factor. The ability to quickly integrate emerging technologies and adapt to new industry trends can make the difference between leading the market and falling behind. Partners who actively participate in industry innovation initiatives, such as IATA's Think Tank or various aviation technology incubators, often demonstrate this forward-thinking mindset. For example, a partner involved in developing standards for biometric boarding processes or sustainable aviation fuel tracking could provide valuable insights and early adoption opportunities.

- Regular technology refresh cycles are indicative of a partner's commitment to staying current. These cycles should encompass both hardware and software updates, ensuring that the distribution infrastructure remains secure, efficient, and capable of supporting new functionalities as they emerge. A partner might commit to major platform updates every 18-24 months, with more frequent minor updates and security patches.

- In conclusion, future-proofing in airline distribution is about more than just keeping pace with current trends. It requires a proactive approach to anticipating and shaping the future of the industry. By choosing a partner with these qualities, airlines can position themselves to thrive in the ever-changing landscape of air travel distribution. This might involve collaborating on pilot projects for emerging technologies, participating in industry-wide initiatives for standardization, or co-developing innovative solutions to address long-standing challenges in airline distribution.

|

Future-proofing Factor |

Importance Score (1-10) |

Implementation Complexity (1-10) |

|

NDC and ONE Order Expertise |

9 |

8 |

|

R&D Investment |

8 |

7 |

|

Clear Technology Roadmap |

9 |

6 |

|

Long-term Support and Maintenance |

8 |

7 |

|

Flexibility for Future Needs |

9 |

8 |

|

Regular Technology Refresh Cycles |

7 |

6 |

|

Industry Innovation Participation |

8 |

5 |

Table 2: Key Future-in Airline Distribution: Importance vs. Implementation Complexity [8]

III. IMPLEMENTATION CONSIDERATIONS

When implementing New Distribution Capability (NDC) API integration with the chosen partner, airlines must carefully consider several key factors to ensure a successful transition and maximize the benefits of this transformative technology [9].

A phased implementation approach is highly recommended to minimize disruption to existing operations. The IATA NDC Implementation Guide suggests that airlines should start with a pilot program, focusing on a specific market segment or route before expanding to full-scale implementation [9]. This method allows for iterative improvements based on real-world feedback and performance data, reducing risks associated with a wholesale change.

Comprehensive testing strategies are crucial for ensuring the reliability and robustness of the NDC integration. Load testing is essential to verify that the system can handle peak traffic volumes, particularly during high-demand periods. IATA recommends that airlines should be prepared to handle at least a 50% increase in API calls during peak booking times [9]. Integration testing is equally important, as it ensures seamless communication between the NDC API and other critical airline systems, such as reservation, inventory, and revenue management platforms. The Implementation Guide recommends a minimum of 500 test cases covering various scenarios to ensure comprehensive integration [9].

Training programs for both internal staff and external stakeholders are vital for the successful adoption of NDC. These programs should cover not only the technical aspects of using the new systems but also the strategic benefits and potential use cases of NDC. For internal staff, this might include hands-on workshops and simulations. For external stakeholders such as travel agents and corporate buyers, airlines should provide comprehensive documentation and support channels to ensure effective utilization of the new NDC capabilities. The IATA guide emphasizes the importance of creating a dedicated NDC education portal for travel partners to facilitate faster adoption [9].

Establishing clear Key Performance Indicators (KPIs) is crucial to measure the success of the NDC implementation.

IATA emphasizes the importance of monitoring metrics such as:

- Conversion rates for NDC-enabled bookings compared to traditional channels

- Average revenue per booking through NDC channels

- Adoption rates among travel agents and other distribution partners

- System performance metrics, including response times and uptime

- Time-to-market for new products and services introduced via NDC [9]

The Implementation Guide suggests that airlines should aim for at least a 10% improvement in these metrics within the first year of full NDC implementation [9].

By consistently monitoring these KPIs, airlines can quantify the impact of their NDC implementation, identify areas for improvement, and make data-driven decisions to optimize their distribution strategy. IATA recommends quarterly reviews of these metrics to ensure ongoing optimization of the NDC strategy [9].

In conclusion, a successful NDC API integration requires careful planning, comprehensive testing, thorough training, and continuous monitoring. By addressing these implementation considerations, airlines can navigate the complexities of NDC adoption, minimize disruptions to their operations, and position themselves to thrive in the evolving landscape of airline distribution. As the industry continues to evolve, staying abreast of best practices and emerging trends in NDC implementation will be crucial for maintaining a competitive edge in the digital age of air travel [9].

Conclusion

In conclusion, the selection of an appropriate NDC API partner is a critical decision that can significantly impact an airline\'s distribution strategy and customer experience. By thoroughly evaluating potential partners based on the seven key attributes discussed in this article – technical skill, airline industry knowledge, project management experience, market knowledge, quality and operational excellence, NDC certification, and future-proofing capabilities – airlines can position themselves for successful NDC implementation and establish robust, strategic distribution partnerships. As the airline industry continues to evolve in response to technological advancements and changing consumer demands, the right NDC API partner will play an instrumental role in helping airlines navigate the complexities of modern distribution, enhance their offer management capabilities, and ultimately deliver superior value to their customers. This strategic partnership will be crucial for airlines to thrive in the dynamic and competitive landscape of air travel distribution.

References

[1] SITA, \"Air Transport IT Insights 2023,\" SITA, 2023. [Online]. Available: https://www.sita.aero/resources/surveys-reports/air-transport-it-insights-2023/ [2] CAPA - Center for Aviation, \"The Future of Airline Distribution: NDC and Beyond,\" Amadeus Insights, 2023. [Online]. Available: The Future Of Airline Distribution. NDC And Beyond | CAPA TV (centreforaviation.com) [3] “Journal of Air Transport Management,” vol. 89, Elsevier, Oct. 2020. [Online]. Available: https://www.sciencedirect.com/journal/journal-of-air-transport-management/vol/89/suppl/C [4] N. Bouarfa, H. Blom, R. Curran, and M. Everdij, \"Agent-based modeling and simulation of emergent behavior in air transportation,\" Complex Adaptive Systems Modeling, vol. 1, no. 15, 2013. [Online]. Available: https://link.springer.com/article/10.1186/2194-3206-1-15 [5] Project Management Institute, \"Pulse of the Profession 2023: Elevating the Value of Project Management,\" PMI, 2023. [Online]. Available: https://www.pmi-pulse-of-the-profession-2023-report.pdf [6] International Air Transport Association, \"World Air Transport Statistics 2023,\" IATA, 2023. [Online]. Available: https://www.iata.org/en/publications/store/world-air-transport-statistics/ [7] International Organization for Standardization, \"ISO 9000 family — Quality management,\" 2023. [Online]. Available: https://www.iso.org/iso-9001-quality-management.html [8] ReadkonG, \"The Future of Airline Distribution, 2016-2021,\" 2023. [Online]. Available: The Future of Airline Distribution, 2016 2021 - By Henry H. Harteveldt, Atmosphere Research Group - IATA (readkong.com) [9] UNDP Climate Promise, \"NDC Implementation Guide,\" IATA, 2023. [Online]. Available: NDC Implementation Guide | Climate Promise (undp.org)

Copyright

Copyright © 2024 Shahan Taj Mohammed. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64256

Publish Date : 2024-09-17

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online